what is the income tax rate in dallas texas

Texas corporate income tax is a business tax levied on the gross taxable income of most businesses and corporations registered or doing business in Texas. Effective personal income tax rate.

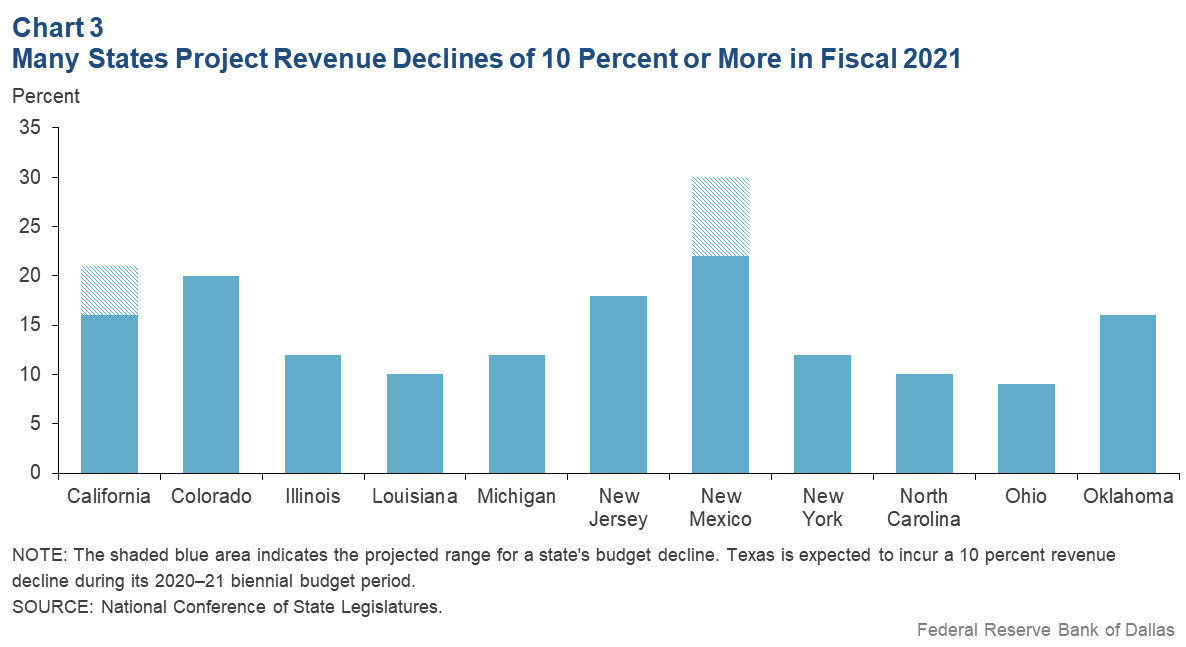

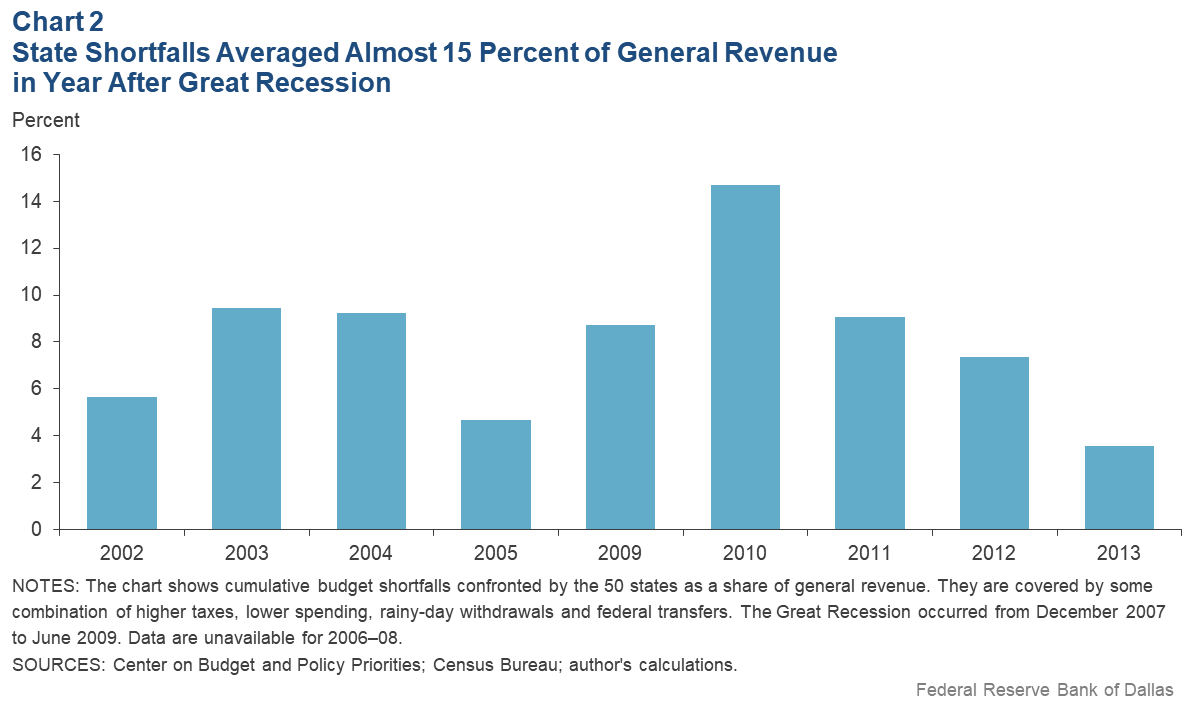

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Discover Helpful Information And Resources On Taxes From AARP.

. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. Your hourly wage or. New employers should use the.

Download our checklist to learn about establishing a domicile in a tax-advantaged state. As of the 2010 census the population was 2368139. Texas income tax rate.

The Dallas sales tax rate is. Heres Teleports overview of personal corporate and other taxation topics in Dallas Texas. It is the second-most populous county in Texas and the ninth-most.

How Your Texas Paycheck Works. Your 2021 Tax Bracket To See Whats Been Adjusted. Texas income tax rate and tax brackets shown in the table below are.

Theres no personal income tax and theres no. The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas. Texas Income Tax Calculator 2021.

Ad Compare Your 2022 Tax Bracket vs. What You Need to Know About Dallas Property Tax Rates. If you make 55000 a year living in the region of Texas USA you will be taxed 9076.

Ad Due to the new tax laws relocating to Texas could have many tax advantages. This is the total of state county and city sales tax rates. Your average tax rate is.

The Texas sales tax. What is the sales tax rate in Dallas Texas. Texas state income tax rate for 2022 is 0 because Texas does not collect a personal income tax.

Currently Texas unemployment insurance rates range from 031 to 631 with a taxable wage base of up to 9000 per employee per year. For the 31000-51000 income. Floridas effective real estate tax of 089 is lower than Texas rate and the national average rate.

Texas is No. 100 rows Dallas County is a county located in the US. That means that your net pay will be 45925 per year or 3827 per month.

If you make 70000 a year living in the region of Texas USA you will be taxed 8387. Census Bureau Number of cities that have local income taxes. The minimum combined 2022 sales tax rate for Dallas Texas is.

The CFED chart is s based on 2007 data from the Institute on Taxation and Economic Policy and theres more information. The Texas Franchise Tax. Like Texas Florida does not have an individual income tax.

Your Effective Tax Rate for 2022 General Tax Rate GTR Replenishment Tax Rate RTR Obligation Assessment Rate OA Deficit Tax Rate DTR Employment and. Annual income 25000 40000 80000 125000. In terms of taxes Texas is one of the best states you can live in.

On average Floridians pay 1914. Texas state income tax rate for 2022 is 0 because Texas does not collect a personal income tax. Your average tax rate is 1198 and your marginal tax rate is 22.

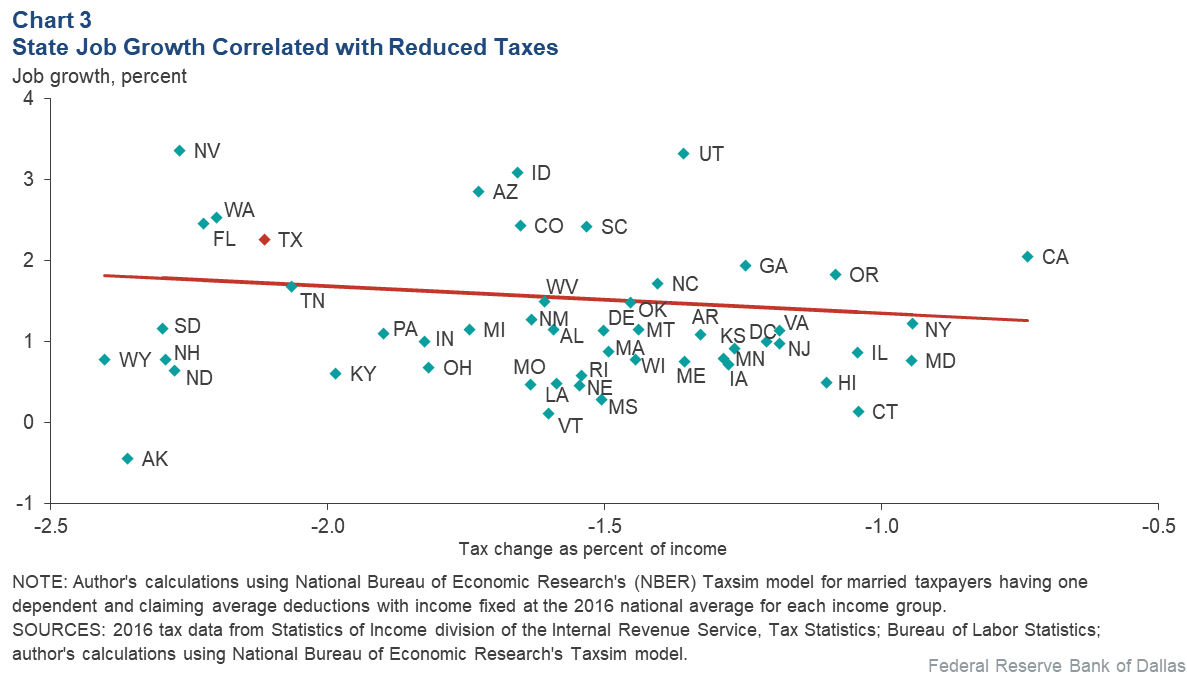

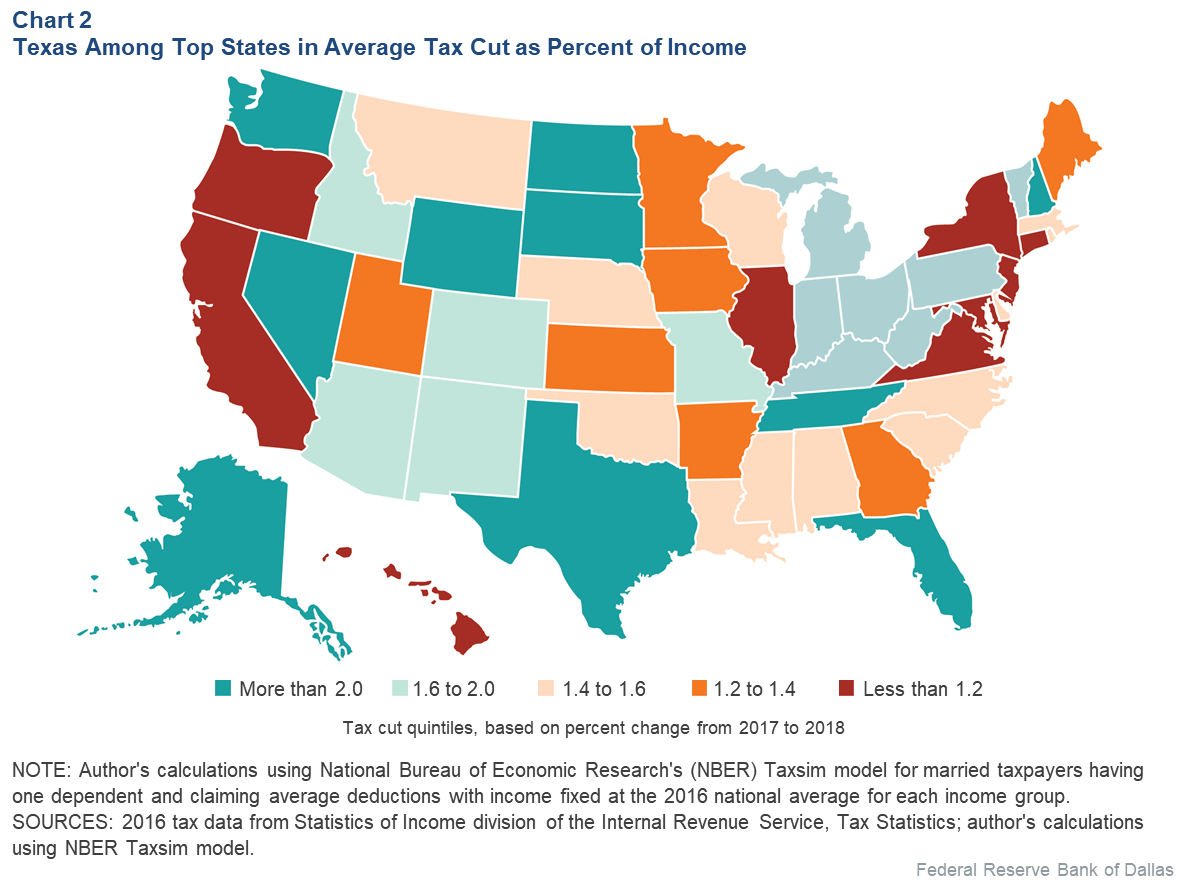

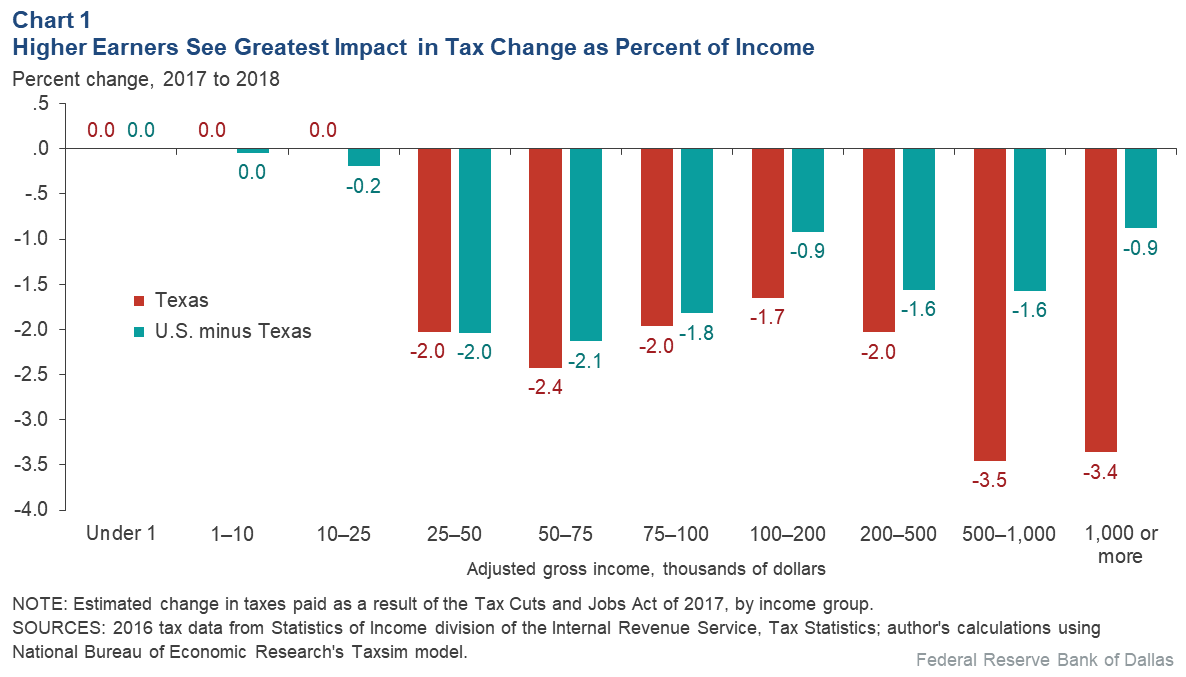

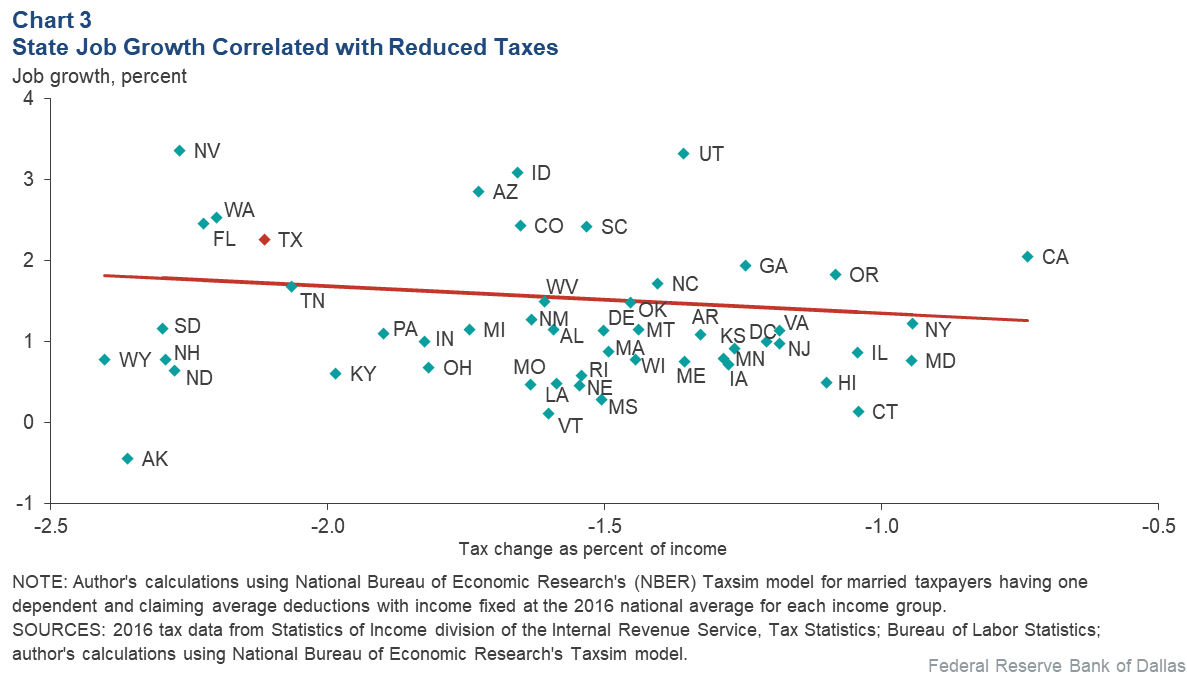

Texas Sees Job Output Gains From 2018 U S Tax Cut Dallasfed Org

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Schedule C Income Mortgagemark Com

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

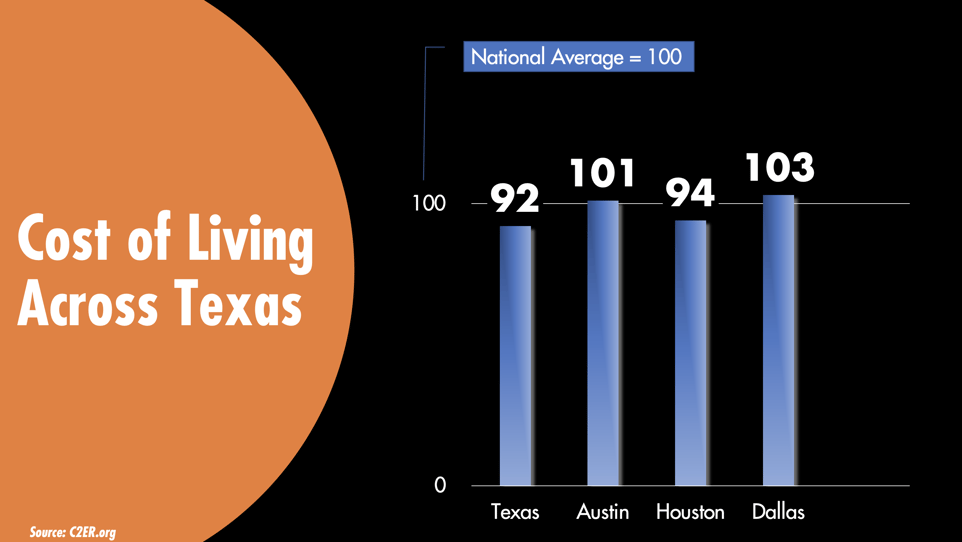

6 Reasons Why Texas Trumps All Other U S Economies

Tax Rates City Of Richardson Economic Development Department

Should I Move My Business To Texas 5 Key Considerations

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

6 Reasons Why Texas Trumps All Other U S Economies

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Texas Sees Job Output Gains From 2018 U S Tax Cut Dallasfed Org

Best Cheap Car Insurance In Dallas Bankrate

6 Reasons Why Texas Trumps All Other U S Economies

The Best Places To Live In Texas That Aren T Austin Or Houston

Texas Sees Job Output Gains From 2018 U S Tax Cut Dallasfed Org

Tax Increment Financing Districts City Of Dallas Office Of Economic Development